A Student’s Experience is Dictated by Funding

As A Level results day approaches later this month, many students, and for that matter many of their parents, will be focused on their funding – how exactly will they pay for their university experience? Many reading this article will look back fondly at their time at university when thanks to realistic maintenance loan levels, or indeed grants, they had the opportunity to study and also participate in the numerous clubs and societies that exist at our HE institutions. Some remind me that they had a part-time job and are quick to say “it never did me any harm”, but what was that paid employment for? Was it to fund a very active social life or as is the case for the 68% of students in part time work today (SAES-2025_FINAL_WEB.pdf), to fund life essentials such as food.

If we accept that university is more than just getting a degree and that the overall experience is an essential part of the process, particularly at undergraduate level, then it should be a real concern to all that a significant proportion of today’s students are being excluded from what might be termed as “normal university life” due to a lack of funds. If we think university should be just about getting a degree, then there are far more cost-effective models than the residential model which apparently remains the aspiration for the majority. However, if your personal financial circumstances dictate what you can get from this residential model, is that really fair?

Last year a report commissioned by TechnologyOne and carried out by the Centre for Research in Social Policy at Loughborough University identified a Minimum Income Standard (MIS) for students A-Minimum-Income-Standard-for-Students.pdf . It put figures on how much money is needed not just for clothes, food and rent but for full participation in university life. The report calculates that, including rent, students need £18,632 a year outside London and £21,774 a year in London to meet MIS. However, this report focused on students living in off-street housing rather than PBSA.

As highlighted in a recent HEPI blog The hidden cost of learning: how financial strain is reshaping student life - HEPI a further report will be published on August 12th, Minimum Income Standard for Students 2025 (MISS25), which will focus specifically on first-year students living in purpose-built accommodation, so it should make interesting reading for all. Let’s be honest we can’t expect it to be good reading!

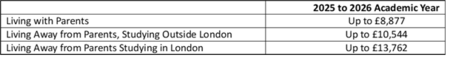

That having been said, there are those who still seem to believe that the current level of student support is adequate but let’s have a look at the maintenance figures for 2025-26:

So, broadly speaking there is an £8k gap for those students studying away from home compared to the MIS figures but it is important to remember that these are the maximum loan figures which only a minority of students receive. The majority get far less, and I think my well repeated fact of a family with 2 parents on minimum wage exemplifies the point. In these circumstances, assuming they both work a 35-hour week, their household income would be around £ 44,500, and the student would be subsequently limited to a loan of £ 7,608 if studying outside London ie the parents would be expected to make up the £ 2,936 difference, which given today’s cost of living crisis must be questionable and the student would face an £11k shortfall in funding to reach the MIS figure. Clearly the need to find £11k from predominantly part time employment puts many off studying away from home and looking to their local university.

Personally, I have always found that the Living with Parents allowance is very generous compared to those students who have moved out of the family home. I am not saying that in itself it is sufficient but what is the difference? Students studying at home have no additional rent cost although I recognise, they may make a payment to their parents and have travel costs but gone are the days when all residential students live on campus and walk to their lecture hall. The growth in student numbers has seen many students living some distance from their university and incurring substantial travel costs. Since maintenance loan figures were set all categories as per the table above have increased with the same percentage inflator and yet as is widely known rents have vastly outrun RPI or any other inflation measure for that matter, creating a greater shortfall for students living away from home compared to their home-based commuter friends.

I am sure the MISS25 report will make interesting reading for all of us involved in the PBSA world, but it won’t change the fact that the student maintenance loan system is completely broken and in its present form is creating a chasm in the experience of students whilst at university created by the levels of financial support received from family – surely this cannot be right? For those involved in student accommodation, the benefits of a rounded residential experience with all students being able to participate in every aspect of university life, must be better communicated if it is to remain the aspiration for a significant proportion of today’s UK school-leavers. Only then can there be any hope of a fair and appropriate funding structure being implemented.